Stock Market News ; Nifty50 halts 5-day losing streak but ends 14 pts shy of 17,000, Sensex up 79 pts

FMCG, select banks help Sensex, Nifty snap 5-day losing streak; Metals dip

Nestle, Titan, Hindustan Unilever and Asian Paints were the major gainers among the Sensex-30 pack; while Tata Steel, IndusInd Bank and Bharti Airtel were the top losers.

Zee Entertainment Enterprises (ZEEL), Shares surged 8% to Rs 204.25 on the BSE

Zee Entertainment Enterprises (ZEEL) is set to repay dues owed to IndusInd Bank in a move that could see the lender withdraw insolvency proceedings against the media giant.

Shares in ZEEL surged 8% to Rs 204.25 on the BSE following the news.

The settlement, which amounts to approximately Rs 83.7 crore, could be completed as early as Friday, paving the way for ZEEL to move closer to completing a merger with Sony Group unit, SPNI.

The merger is expected to create a $10 billion media giant.Zee Entertainment Enterprises (ZEEL), Shares 8% to Rs 204.25 (investonomic.co.in)

Credit Suisse To Borrow Up To $54 Billion In Bid To Calm Investor Fears

Credit Suisse has announced plans to strengthen its liquidity by borrowing up to $54 billion from the Swiss central bank, following a significant drop in its share price and a spike in its credit default swaps.

The move is aimed at restoring confidence in the bank and alleviating fears about a broader bank deposit crisis.

As part of its plan, Credit Suisse will also repurchase senior debt securities for up to about 3 billion francs ($3.2 billion).

The Swiss National Bank had offered to provide a liquidity backstop if needed, and Credit Suisse said it was taking “decisive action” to address the situation.

ED conducts raids on Franklin Templeton officials; unusual withdrawals, dubious deals under scanner

The Enforcement Directorate (ED) has launched a money laundering investigation against asset manager Franklin Templeton and its former and current executives.

The federal agency is conducting searches at various locations in Mumbai and Chennai in order to gather further evidence under the Prevention of Money Laundering Act (PMLA).

The probe is related to allegations of irregularities in the running of six debt schemes that resulted in the schemes being wound up in April 2020 due to liquidity challenges caused by the COVID-19 pandemic.

The capital markets regulator, Sebi, had issued a show-cause notice to the company in November 2020, which eventually led to Franklin Templeton being fined Rs 5 crore and banned from launching new debt schemes.

The Chennai police economic offences wing (EOW) subsequently registered an FIR to investigate the alleged irregularities, leading to the ED’s money laundering investigation.

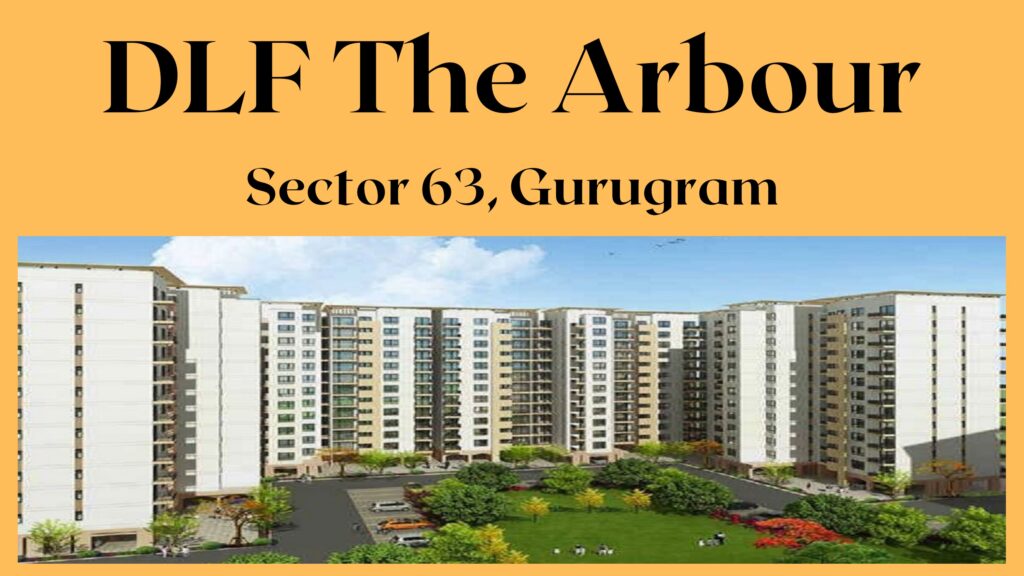

DLF made Rs 8000 crore just in three days by offering 1,137 luxurious flats

DLF, India’s biggest publicly traded real estate firm, has reportedly recorded a pre-formal launch sales of over Rs 8,000 crores for its luxury high-rise residential project, The Arbour.

The project, located in DLF Sixtythree on Golf Course Extension in Gurugram’s Sector 63, consists of five unique structures that stand 38 to 39 stories tall and span over 25 acres.

The complex offers 1,137 luxurious and spacious 4 BHK + study + utility room layouts, with prices starting at Rs 7 crores.

Even before its official launch, The Arbour had sold out completely, according to a press release from DLF.

This development marks DLF’s entry into the Golf Course Extension mini market.