Stocks Trading below Rs 100. Many stocks are trading below Rs 100, Here are some of stocks out that lists for your education purposes.

Disclaimer: This article is for education purpose only. We are not advising or suggesting any investment or trade in these stocks.

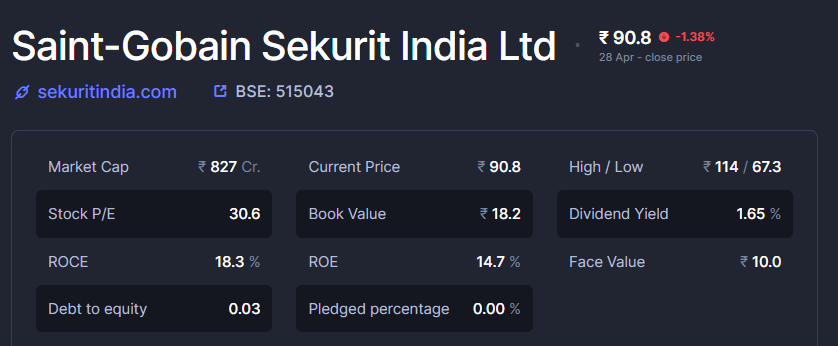

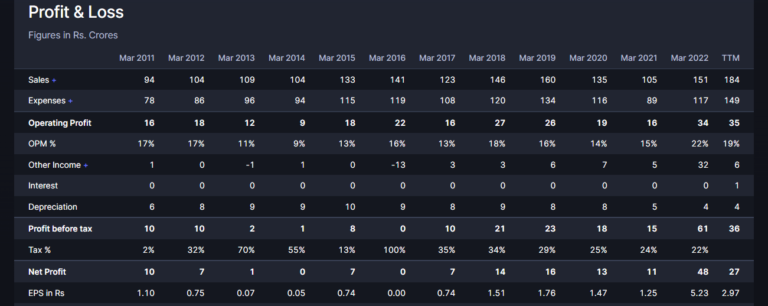

Saint-Gobain Sekurit India Ltd ₹90.8

Established in 1973, Saint-Gobain Sekurit India Limited is a subsidiary of Compagnie de Saint-Gobain(a transnational group with its headquarters in Paris). The Company is engaged primarily in the business of manufacture and sale of automotive glass. It offers its products mainly to 3 wheelers, Passenger Vehicles and Commercial Vehicles

KEY POINTS

- The company specializes in producing laminated and tempered glasses for automobiles.

- Laminated glass is used in windshields, while tempered glass is used in backlights and sidelites.

- More than 99% of the company’s revenue comes from laminated glass, while less than 1% comes from tempered glass.

- The company has a single manufacturing unit located in Pune, Maharashtra.

Also read ; India’s Growing Role in European Energy Security After (investonomic.co.in)

- The company is a part of the Saint-Gobain group and undertakes related-party transactions with subsidiary companies, including the purchase of goods and IT support services.

- In FY22, it purchased goods worth 48 crores from related parties.

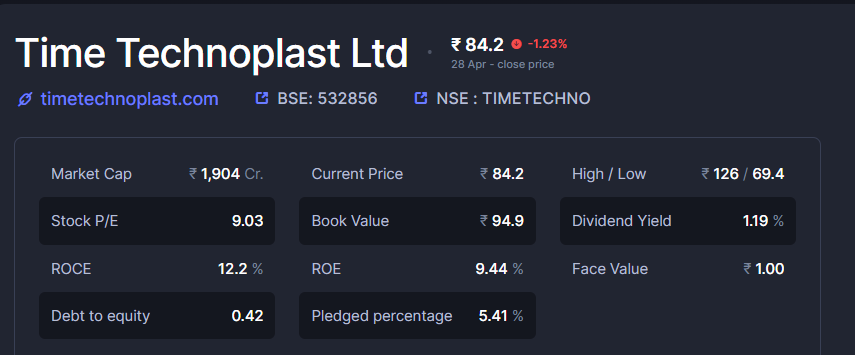

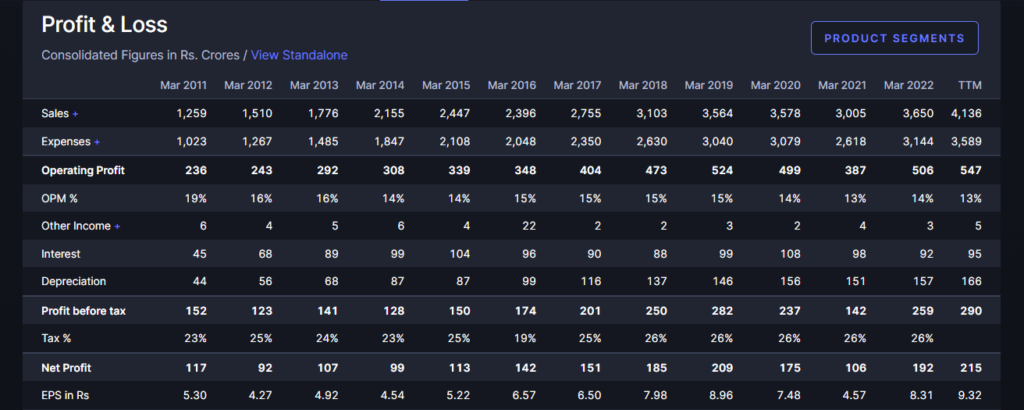

Time Technoplast Ltd ₹84.2

Time Technoplast is a multinational conglomerate involved in the manufacturing of technology and innovation driven polymer & composite products.

The company is a leading manufacturer of large-sized plastic drums with a dominant market share of around 60%. Additionally, it is the second-largest producer of composite cylinders and the third-largest manufacturer of intermediate bulk containers.

The company’s product portfolio is divided into four segments, with industrial packaging accounting for 75% of its total revenues.

The majority of its customers in this segment are from the chemical and FMCG industries, with domestic sales making up 66% of the revenue and international sales accounting for the remaining 33%. The company follows a cost-plus pricing model for its products.

Also read ; शून्य निवेश; बिजनेस आइडिया और निष्पादन रणनीति रणनीति (investonomic.co.in)

The infra segment contributes 15% of the company’s revenue, and includes products such as pipes and prefabs.

The lifestyle segment, which comprises items such as mats, contributes 5% of the company’s revenue, while automotive components make up the remaining 5%.

Overall, the company’s strong market position and diverse product portfolio across multiple segments make it a leading player in the industrial packaging space, with significant growth opportunities both domestically and internationally.

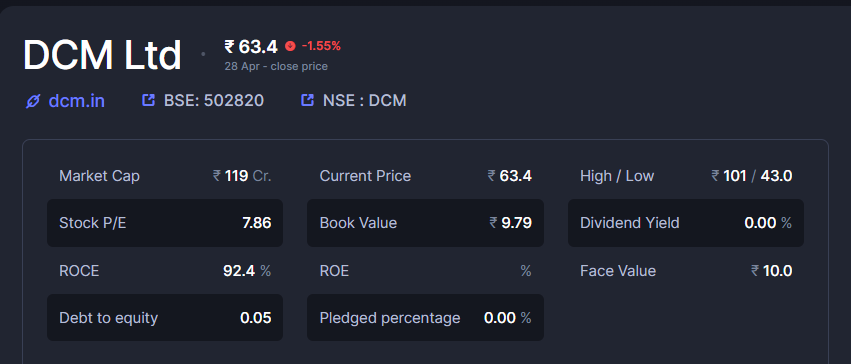

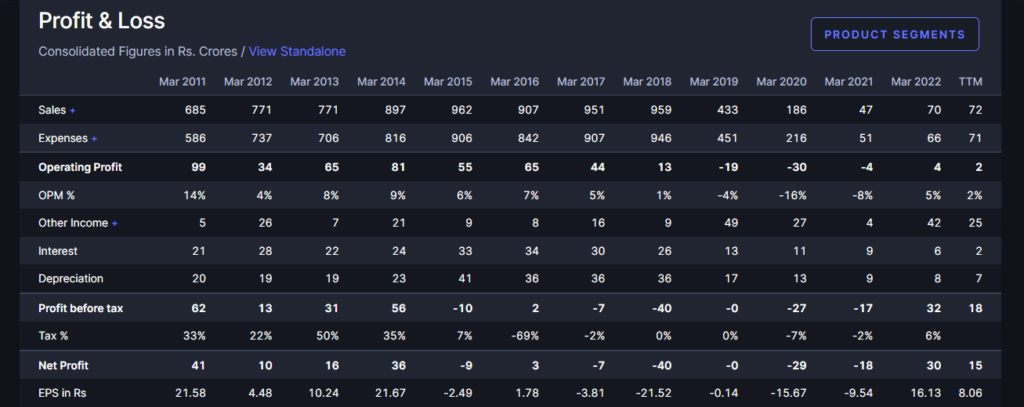

DCM Ltd ₹63.4

DCM Limited is a diversified company engaged in various business activities such as manufacturing of textiles, grey iron casting, IT infrastructure services and real estate development.

The company has divided its operations into different segments, such as the IT division, which offers services related to system administration, storage management, backup recovery, and disaster management.

Its engineering division is engaged in manufacturing grey iron castings, cylinder heads, and cylinder blocks that are supplied to auto players.

The company’s textile division was demerged into DCM Nouvelle Limited in April 2019.

The company has decided to expand its business into the real estate sector through its wholly-owned subsidiaries, DCM Landmark Estate Limited, DCM Infinity Realtors Limited, and DCM Realty and Infrastructure Limited.

It has also transferred its 16.56% investment in Purearth Infrastructure Limited, a joint venture company, to these subsidiaries to help them mobilize resources for their business operations and provide liquidity to the holding company.

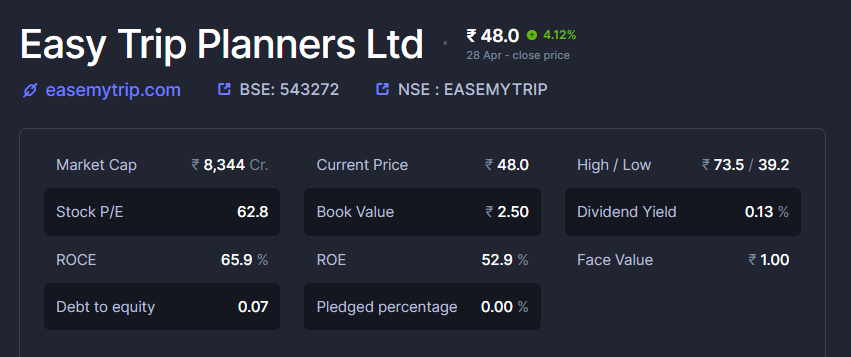

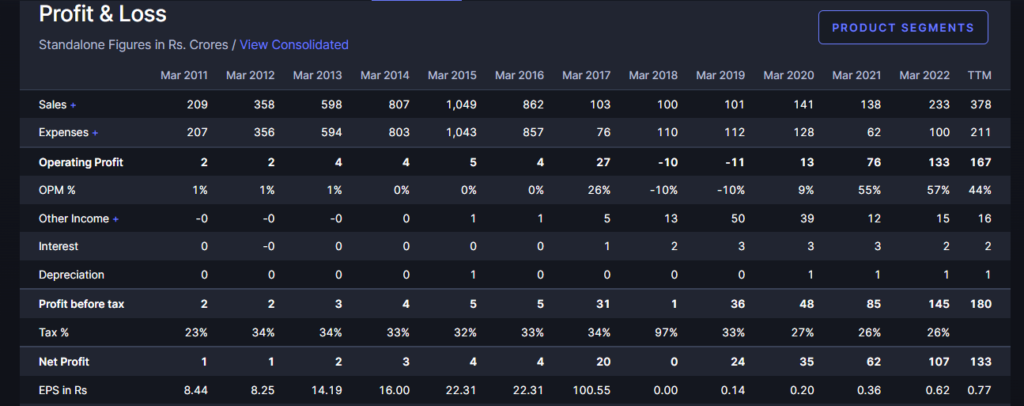

Easy Trip Planners Ltd ₹48

Ease My Trip is a leading online travel portal in India that offers a wide range of travel-related products and services.

The company provides end-to-end travel solutions to its customers, which include airline tickets, hotels, holiday packages, rail tickets, bus tickets, and taxis.

It also offers ancillary value-added services such as travel insurance, visa processing, and tickets for activities and attractions.

Easy Trip Planners (EMT) is the second-largest and only profitable company in the online travel portal industry in India. It is also the fastest-growing company in this sector.

In order to expand its reach and provide better services, Ease My Trip has acquired several companies and formed partnerships with other organizations.

For instance, the company acquired Spree Hospitality, which is a hospitality management company that manages a portfolio of 45 properties across India.

Ease My Trip also acquired YoloBus, a premium intercity bus mobility platform that connects Tier-I to Tier-III cities in India.

Ease My Trip has also formed partnerships with other companies to provide exclusive services to their customers.

The company has entered an exclusive partnership with Flybig, India’s newest regional airline, to sell their tickets on the Ease My Trip platform.

Additionally, the company has partnered with SpiceJet, a budget airline, to power their holiday bookings.

Moreover, Ease My Trip has become the exclusive service provider for all flight bookings at JustDial, a popular online search engine in India.

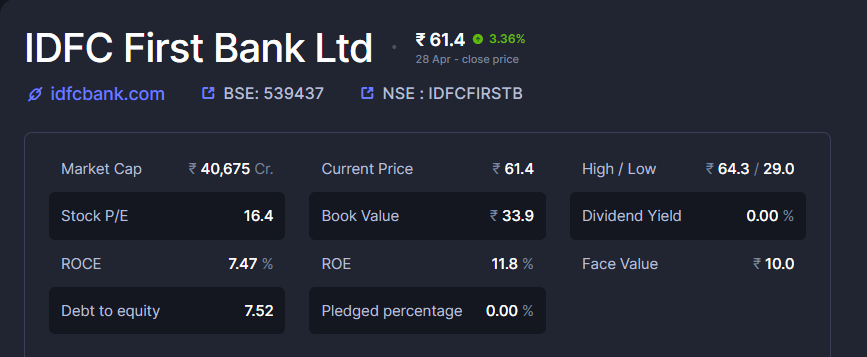

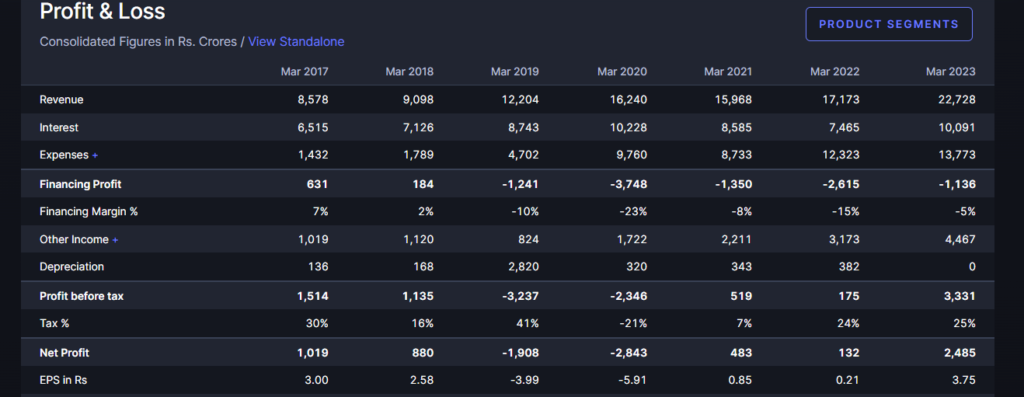

IDFC First Bank Ltd ₹61.4

IDFC First Bank is a banking services provider in India that was formed through the merger of IDFC Bank and Capital First on December 18, 2018.

The bank currently operates a network of 641 branches and 719 ATMs across the country.

In the first nine months of fiscal year 2023, the bank’s capital adequacy ratio was 16.06%, while its net interest margin stood at 6.36%.

The gross non-performing assets ratio was 2.96%, and the net non-performing assets ratio was 1.03%.

The bank’s current and savings account (CASA) ratio was at 50%.

The bank has been undergoing a transformation from a corporate-focused, low net interest margin (NIM) bank to a retail-focused, high NIM bank.

To this end, the bank has scaled up its digital cash management solutions, trade forex, wealth management, FASTag, toll acquiring business, and credit card offerings. It has also introduced new variants of current accounts.

Steel Authority of India Ltd ₹82.8

Steel Authority of India Limited (SAIL) is one of the largest steel-making companies in India and one of the Maharatnas of the countrys Central Public Sector Enterprises.

SAIL produces iron and steel at five integrated plants and three special steel plants, located principally in the eastern and central regions of India and situated close to domestic sources of raw materials.

SAIL manufactures and sells a broad range of steel products.

The company is one of the largest steelmakers in India, with a total crude steel and saleable steel capacity of 19.63 million tonnes per annum and 18.54 million tonnes per annum, respectively, as on 31 March 2022.

As on FY22, the utilisation was 88% and 92% for crude steel and saleable steel

SAIL expects to incur a capex of INR60,000 million- INR80,000 million in FY23. The company’s future capex would be funded by debt and internal accruals in a 50:50 ratio.

L&T Finance Holdings Ltd ₹92.6

L&T Finance Holdings Ltd is a non-banking financial company (NBFC) that provides a diverse range of financial products and services, including farm equipment finance, two-wheeler finance, microloans, consumer loans, home loans, loans against property (LAP), real estate finance, infrastructure finance, and an infrastructure debt fund.

The company is registered with the Reserve Bank of India (RBI) as a Systemically Important Non-Deposit Accepting Core Investment Company (NBFC-CIC) and is a subsidiary of Larsen & Toubro.

L&T Group holds a 63.5% stake in the company, making it an integral part of the L&T Group.

The company receives constant technical and capital support from its parent company.

L&T Finance Holdings Ltd received an equity infusion of Rs. 1,900 crore in FY2021 and Rs. 2,000 crore in FY2018.

Disclaimer: This article is for education purpose only. We are not advising or suggesting any investment or trade in these stocks